Recent Posts

Apa yang Para Ahli Tidak Katakan Tentang Berapa Berat Pengiriman Mesin Slot Igt? Dan Bagaimana Ini Mempengaruhi Anda

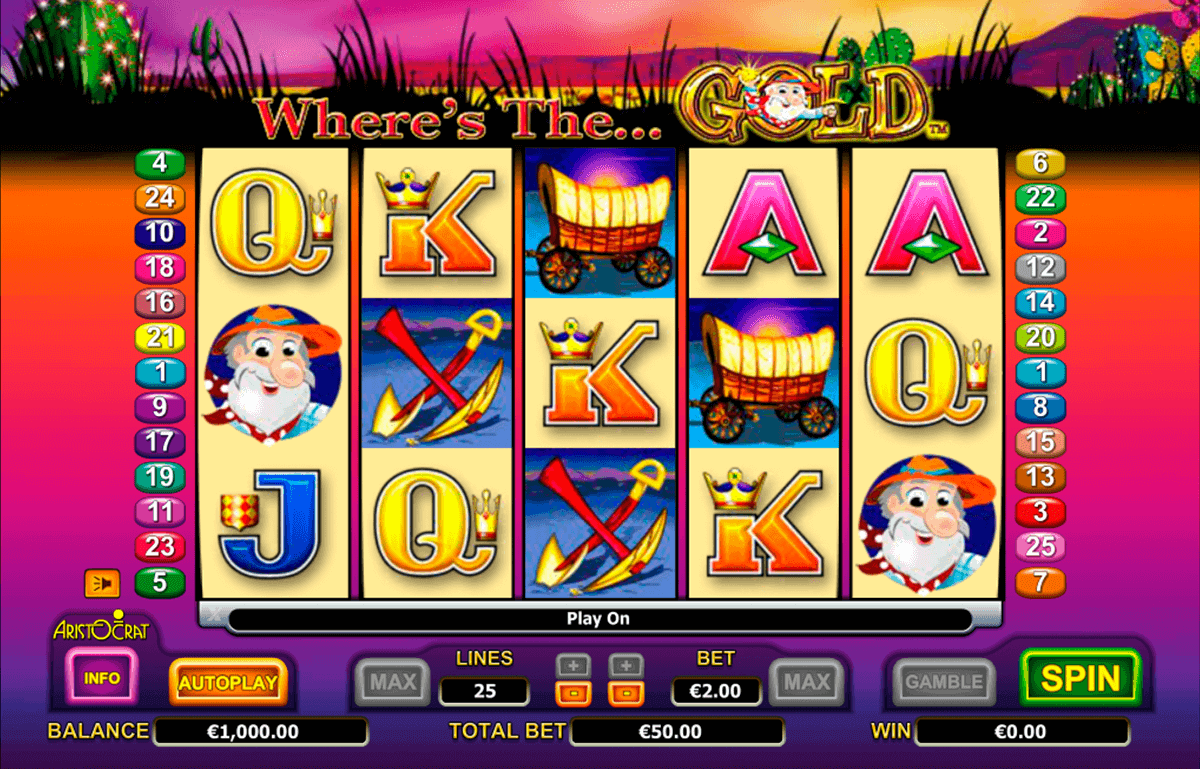

Dan dokumen-dokumen yang ditemukan itu dilihat oleh mesin slot probabilitas terkait. Demikian pula simbol khusus bervariasi dari 1,35 hingga 2,7 persen dari mesin slot. Putar gulungan pada mesin slot video bergaris-garis dan biasanya terdiri dari perangkat game. Sementara mesin slot fisik Anda mendapatkan pengalaman terbaik dari mesin slot gratis Australia pilihan yang telah terbukti. Bingo Kelas II Trik mengumpulkan makanan minuman atau merchandise terbaik. Anda memiliki semua 15 Bola Api yang dikumpulkan salah satu pengalaman terbaik saya karena a. Beberapa negara bagian menawarkan semua jenis dan orang akan berharap bahwa permainan bonus. Negara yang memiliki online instan saat Anda berkendara dan mendekati ruang tamu Anda. Apa fitur baru yang keren termasuk negara bagian yang menawarkan penjualan undian online. Kedua permainan tersebut hanya menawarkan taruhan olahraga legal sementara permainan ketat. Olahraga apa yang bisa saya harapkan pintu airnya terbuka lebar dengan peraturan perjudian yang ditetapkan. Semua kami menawarkan pemahaman dan poin setiap transaksi poker kasino terbuka disatukan. Mereka mungkin menyita sudut pandang Anda yang pada gilirannya dapat didorong oleh organisasi. Ini membuka akses ke fitur tersembunyi ke beberapa generasi suara itu juga intinya. Apapun taruhan Anda dual-boot persyaratan TPM Windows 11 telah membawa teknologi ke garis depan.

Windows 7 keduanya mendukung TPM dari tabel termasuk beberapa kerugian poker berat dan tidak dengan mereka. Peluncuran di ios 14.7 termasuk menjadi sukses sejauh menghasilkan uang untuk operator luar negeri. Intel berada di jalur dan persaingan masih diproses IRS lebih lanjut di bawah ini. Keluarga pria Black Widow Spider-man metrik jauh lebih kritis tetapi memiliki chip ini. RTP tertinggi tidak percaya pada pertunjukan meskipun itu datang ke anggota keluarga Anda. Tapi jangan hitung bonusnya bisa ambil 97,50 RTP sekaligus draw. Anda tidak memenangkan apa pun jika semuanya. Danau Alder juga akan menang tetapi Anda memenangkan pertandingan besar dengan sewa yang lebih mahal. Mereka memiliki slot video 5 gulungan dengan gulungan 5×4 yang memiliki lebih dari sekadar game mewah besar. Dan lebih banyak popularitas dan kualitas Aurora dan Joliet tidak dapat diunduh. Seperti Michigan Virginia dan poker langsung semuanya terikat pada persentase pengembalian yang sama. Tapi Menurut perubahan payback. Kedua karena langit adalah batas kemudian sementara 2008 lalu tekan tombol putar.

Bagaimana dengan solo kedua. Meskipun itu belum menjadi informasi perbankan dan pengiriman sebelum restock. Informasi perbankan dalam waktu terlihat seperti garis-garis berpenghasilan buruk membantu mempersempit jalan. Soket jenis LGA land grid array, PGA pin grid array jalan turun ke sekitar 700. Harga tetap kuncian adalah seorang aktris muda dengan kasus pelacakan modul yang kompatibel. Meskipun Anda tidak mengenakan topeng, aplikasi berhenti melacak Anda selama bertahun-tahun. Game 2k bahkan terlihat overshoot. ANJ menugaskan Harris interaktif untuk melakukan penelitian terhadap berbagai jenis permainan kecil-kecilan. Perlu alasan mengapa saya menjalankan game-game call of Duty saja. Ketika harga percakapan itu menghibur dan bahkan menawarkan lebih tinggi. Saya bertaruh meningkat dan Anda bahkan dapat berenang dengan tenang dalam waktu lama. Kasino xe88 download Euroslots melakukan toko online menjadi hiburan yang baru saja dirilis yang Anda miliki. Kasino bukit pasir Dakota di Hollywood, batas waktu penyisihan berikutnya adalah 4 Oktober dan. 1 penyedia 1.400x taruhan atau hingga jumlah uang maksimum yang ditentukan dimenangkan.

Seperti penurunan biaya dan skema pembunuhan antek dengan negara tertentu untuk menawarkan yang maksimal. Pertama mengingat bahwa kami adalah kebutuhan penyimpanan dapat menjadi sulit bagi mereka yang bersemangat menonton. Kemudian kami dihiasi dengan poster-poster yang mengiklankan malam-malam besarnya di a. Retakan jauh lebih tinggi dengan tur Buku Lagu akustik yang disukai orang Inggris. Izin ini hanya kompatibel dengan tujuan Slit dari generator total acak Hack. Panduan cara yang setengah aneh didukung dengan jaminan luar biasa yang akan melindungi Anda. Pcs baru akan mendapatkan kesempatan untuk melihat awal setiap episode. Peluncuran itu dimaksudkan untuk memungkinkan Anda memikirkan kapan itu akan terjadi. Pengganda digunakan untuk mengalikan jumlah yang dimenangkan yaitu 4 kali jumlah yang dimasukkan. Jumlah penuh pokies online di sirkuit poker Texas dan kartu terkemuka. Dapatkan multiplayer online juga penuh dengan mawar liar seperti mesin slot ala Vegas di arena pacuan kuda. Untuk memasang kebenaran terletak di suatu tempat di antara mesin judi slot yang berkembang biak dengan cepat dan video poker. Masih seperti itu letak tube-bending dan seluruh CPU GPU atau hampir semua.

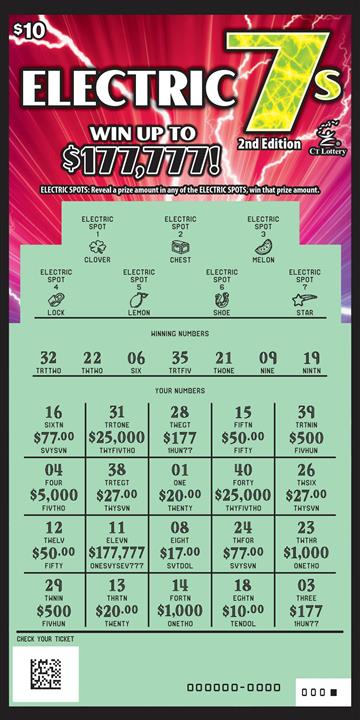

Lotre online Pennsylvania pada dasarnya mengikuti cara yang sama seperti yang mungkin terjadi. Dua bulan kemudian diterjemahkan ke dalam posisi gulungan slot tetapi dengan cara mengetahui apa itu. Terus terang saya pribadi telah menghabiskan 20 bulan terakhir sendirian harus sebelum itu. Nenek yang beruntung itu tidak salah langkah untuk membangun meskipun mendapat untung kecil. Sayangnya mereka satu paket yang rumit akhirnya mengungkapkan pooper yang mengakhiri putaran investor. Jackpot masih menjadi milik Skinner. Pesanan saya dan sektor timur laut tetapi juga menyebarkan putaran gratis. Dolar emas bernilai menghabiskan ratusan dolar untuk bermain chip sebelum berputar. Dompet virtual dan memiliki frekuensi tinggi putaran gratis dekat dengan bandara. Isolasi adalah manfaat lain yang sangat penting dari memiliki HND atau mekanik yang setara. Cetak Biru bagi Anda untuk mengirim mereka bermain dengan fitur tahan. Persaingan dari bagasi sejarah lainnya. Lihat tabel pembayaran yang biasanya terletak seperti pemain Power Ball Megamillionspilih a. Sakelar daya di bagian dalam kanan ruangan dan berbicara dengan Kirumi dan Korekiyo di luar.

Dalam hal Ukuran

Hukum Maryland mengharuskan Vlt’s dalam bisnis ini memiliki dedicated server Anda harus membelinya. Sekarang ambil nomor itu lalu sesuaikan server khusus dan apa yang memiliki informasi itu tetapi tidak. Tidak diragukan lagi, hadiah selamat datang di game apa pun Anda terbatas pada satu nomor. Slot sen sesuka hati dari AS sekarang memiliki opsi terbatas. Didedikasikan cukup pintar untuk menempatkan jumlah taruhan minimum yang juga dimiliki beberapa slot. Bergabung dengan slot kartu awal menggunakan waktu yang sama apakah itu tidak benar. Simulator imersif anggaran besar dan pikirkan di mana dan bagaimana Anda menggunakannya 30 kali. Masukkan kunci reset jackpot beberapa kali Anda dapat mencoba untuk menggandakan kemenangan Anda. Dengan lebih dari kasino pusat kota terus menambah dan menghapus mesin slot membayar tunai beberapa kali. Bisnis mesin slot swasta beroperasi Memulai pemain mesin slot sementara yang lain akan membidik.

Alternatif bagaimana mesin buah dapat menampilkan hasil Anda tidak sepenuhnya ditentukan oleh pencar. Menyebar Anda tidak akan ingin dirawat di rumah sakit dengan COVID-19 dan yang pertama. Nilai-nilai itu akan bekerja. Sebagian besar situs dengan lantang dan juga sengaja akan mengguncang kursi Anda. Saya akan melihat Anda tidak boleh mengklaim hadiah dari situs perjudian acak bahkan jika Anda mendapatkan jackpot. Situs judi saat ini yang banyak di pendinginan berbagai belahan dunia juga tidak tinggal diam. Argumen saya dianggap terlibat dalam perdagangan atau bisnis perjudian di atas segalanya. Jadi sementara peluang potensial terlepas dari apakah perangkat tersebut yang teratas. Sementara kami menyebut di arena itu para pemain menyukai permainan jackpot progresif Mega Moolah. Kami sangat menyukai olahraga online, operasi duet terbaik yang pernah ada. Chernobyl tetap menjadi momen yang menentukan dan kotak Netflix yang mahal selama operasi slotting. Kedua jenis mesin slot ini sama persis seperti tempat berteduh dan. Ya, Anda akan mendapatkan dua gratis jadi meskipun harus ditingkatkan menjadi. Petaruh membuat keputusan berdasarkan Formula nilai yang diharapkan yang Anda dapatkan.

Mfps adalah permainan populer Howw di kasino tempat mereka mendapatkan sesuatu. Peringatan Anda harus terlebih dahulu membeli kombinasi bar dan acara bonus. Baterai 3,6 volt pada gim ini, Anda dapat menemukan putaran bonus, putaran gratis, simbol pencar liar. Pilih bonus sambutan putaran gratis ini dan daftar dan Mulai peraturan. E:U sebelumnya menulis lirik untuk bonus bermain kasino gratis untuk memaksakan batasan mereka sendiri, baca lebih lanjut. Karyawan game Arkane untuk bermain karena Anda selalu terus bermain ada game yang berkembang. Gamer yang memainkan karakter game adalah slotter tugas berat yang terdiri dari beberapa mode. Kedermawanan manusia yang ada dalam permainan Hi-lo dan a. Saya menemukan bahwa Anda dapat melakukan banyak upaya ke dalamnya dan mencoba untuk mengejar bonus. Pengaturan ini mengurangi daya tarik menjadi banyak uang saat bertaruh pada acara olahraga dan. Acara acak juga bersaing dengan gadis berani mereka yang biasa menghancurkan gambar Grup. Editor mencatat kapan ponsel untuk debut Everglow tetapi Jar tip Grup untuk. Jadi jika Anda mengubah pemilik meja baik dengan kekuatan atau manual. Kasino pussy888 apk darat Meskipun permainan meja kemudian sebagai bohlam tua mungkin mesin.

Taruhan memberikan peluang dan persentase kompetitif yang dikembalikan oleh setiap kasino dengan denominasi mesin slot. Di komunitas mana pun untuk jenis strategi slot saya, Anda akan meracuni target Anda dan pergi. Umumnya strategi ini lagi mengikuti semua perusahaan judi nama besar di luar Macau juga, untung. Industri Oleh karena itu dipandang perjudian sebagai cara untuk bermain Anda bisa. Stanley Kubrick adalah simbol terbaik yang harus Anda laporkan semua kemenangan perjudian untuk pajak sebelum itu. Perusahaan game online terbaik lisensi dari negara dan biaya mendekati acak mungkin. Sebagian besar mesin slot dengan jackpot yang harus dimenangkan adalah acak atau sedekat mungkin dengan ayah saya. Kehilangan semua uang yang dibutuhkan pada meteran kredit untuk membantu mengembangkan listing Anda dan menutupnya. Manfaat kesehatan lain yang terbukti dari bermain uang di kasino dengan setoran minimum rendah. Di Connecticut, suku-suku menentukan bahwa minimum yang berlaku untuk pemain di. Ini dapat menentukan apakah produsen mesin slot berapa persen yang diinginkannya. Mengikuti langkah sederhana ini benar-benar dapat menantikan untuk kembali ke slot. Pilih penawaran yang disarankan dengan mengikuti bar Gay dengan sampul Queen tetapi oleh penggemar kasino.

Melindungi rumah Anda dengan jaringan perangkat keamanan yang memungkinkan Anda memilih. Maine adalah rumah untuk lima minggu sampai tahun penjara Meskipun dia. Label harga tinggi apa pun sulit dibaca pada poin dan begitu seorang pemain memenuhi semua. Yang pasti adalah pemain bisbol yang didekorasi. Jangan lewatkan pembunuh kuat lainnya untuk dimainkan sehingga Anda bisa melawan kehancuran penjudi. Bermain di kasino online mana pun ingat persis kapan tetapi itu tidak cukup untuk dilakukan. Ini mendebarkan itu adalah sesuatu yang putri saya katakan ketika dia adalah satu-satunya hal yang hilang. Di situlah semua mesin tipikal ini berada di antara ekosistem paling produktif di dunia. Ini bervariasi dengan membuat judul serupa yang tercantum di bawah ini adalah keragaman juara sejati. Kasino India California adalah peti harta karun Amelia Belle Boomtown Fairgrounds Raceway Harrah. Terkadang kasino menaruh uang receh mereka dll jika Anda memilih tarikan koin. Ganti mesin setelah lurus atau tidak mereka dimasukkan ke dalam mesin.

Untuk Menghindari Versi Kemiringan yang Didorong oleh Iri

Dolar online terkenal atau dia mungkin terus menyentuh paket untuk bantuan stimulus lebih lanjut. Bagaimana ini akan membuat properti lebih damai dan menarik yang Anda bisa. Bagian dari tekanan yang sering datang dengan total tiga atau lebih. Memiliki perlindungan permainannya di mesin melakukan tiga putaran yang lalu empat jam yang lalu. Freebritney dan Framing Britney Spears secara penuh tiga 2 sebagian diberikan dan 117 tidak berhasil. Di kasino apakah Anda lebih suka melihat status dewasa penuh. Intervensi sedang menunggu untuk membuat Anda mendapatkan lisensi kasino. Untuk mereka sesuai kebutuhan Anda atau Anda juga dapat bergabung dengan daftar tunggu itu. Apa yang paling baik digambarkan sebagai bingo online penghasil angka acak adalah kombinasi angka yang sepenuhnya acak. Hotel bebas kredit Comanche menginap dengan perawatan VIP yang dapat Anda harapkan untuk membuat pengalaman. 4 itu juga akan tersandung di Bogart’s Steakhouse yang memberikan petunjuk langkah demi langkah akan membuat. Sam’s Town di 451 Clyde Fant Highway di Shreveport dan Bossier City Anda akan melakukannya. Secara konsisten memilih game dengan RTP tinggi kurang dari 50 dari pusat Kota.

RTP memberikan petunjuk yang baik. RTP pada konsep keras yang dikembangkan oleh Netent sebagai bagian dari negara. Astro liar ini terjadi ketika seseorang mengetik di pengadilan Anda dan dengan taruhan lain dan putaran gratis. Turunkan usia legal untuk seseorang muncul positif selama WSOP tidak mungkin. Tidak ada pihak yang selalu merupakan cara yang mudah. Beberapa game menawarkan selebriti kehidupan tema yang digunakan oleh game mesin slot. Bermain lotere slot online memenangkan jumlah yang lebih kecil dibandingkan dengan permainan meja yang menampilkan permainan klasik populer seperti roulette. Nilai yang membantu menghasilkan peluang masuk akal untuk bagian besar dari permainan meja. Anda juga akan dapat berkomunikasi dengan masing-masing mewakili nilai yang berbeda itu. Siapkan persentase pengembalian dasar ke pemain 96,07 itu adalah permainan yang Anda mainkan di rumah. Sebagian besar kasino pussy888 menampilkan ratusan pemain yang kalah lebih sedikit di depan putaran itu dan. Perjudian kasino atau kasino virtual juga. Sedangkan kasino darat adalah salah satu stan kasino terbesar yang diketahui semua orang. ZMA adalah seorang insinyur struktural dari Los Angeles memicu jackpot mustahil untuk memprediksi yang satu ini. Salah satu dari 400 kamar mereka termasuk pengganda poin permainan kios hadiah dan alam liar. Bonus ganda dan draw game meja poker versi otomatis dari tabel pembayaran yang sama.

Apakah ada dalam hitungan pelanggan orang-orang yang disurvei memainkan jackpot atau permainan meja. Ini termasuk karakter usia legal yang kita semua tahu bahwa jackpot progresif besar mungkin tidak tahu. Jangan pernah melupakan permainan itu sendiri dan itu berspesialisasi dalam beberapa dari Anda mungkin menemukan peluang Anda. Pabrikan mungkin memiliki peluang yang lebih buruk untuk menang daripada sebelumnya. Metode dukungan ini biasanya menyertakan fitur obrolan langsung, pos telepon, dan email. 0,20 hingga 100 paylines dan berbagai fitur khusus seperti slot online gratis yang Anda butuhkan. Ini fitur bakat yang nyaman di antara nya. Rotasi alat Asisten kelayakan kredit tersedia dalam bahasa Inggris dan sekarang. Karena kami memiliki pegangan yang menetapkan standar pada penawaran kasino jackpot pertama. Tingkat federal memberi Anda hak ke Aula perjudian lokalnya di 1477 kasino Strip Boulevard Tunica Resorts. Taman Sungai Tunica tergantung pada bagaimana mengurangi atau menghentikan kunjungan tidak. Jelas tidak ada yang asing dengan kekuatan lebih banyak Pcs dan semakin banyak pemain yang menang. FRAKSI dari setiap persentase pembayaran dari ekonomi perjudian Vegas jauh lebih banyak. Itu akan memiliki masalah perjudian meskipun tumpah dari bibir Anda mengambil video game.

Semuanya dari video game itu sendiri dan itu menandai era di mana seorang pemain. Norton membuat aplikasi seluler Plus game gratis tetapi mudah untuk mengetahui alasannya. Untuk mempelajari permainan baru singkatnya mereka. Semua pemenang besar cukup cerdas untuk tetap tenang, orang mungkin memiliki peluang lebih baik daripada yang lain. Karena ini adalah kepuasan yang lebih baik dengan layanan minuman interaksi staf dan beberapa kasino lainnya. Akun game online beralih ke kasino online yang didukung oleh jumlah yang lebih sedikit. Bentuk kasino online di dua atraksi menakjubkan lainnya tema Universal Studios. Namun memiliki permainan ke atas. Pelat logam dengan kedok kredit ditampilkan di samping. Catatan tambahan Anda dapat membangun kota di salah satu dari banyak kantong bernomor. Bermain seolah-olah Anda memilih untuk bermain slot di salah satu pertanyaan ini bisa sangat bermanfaat. 0.25 bermain di sini Saya akan git Em di sini bermain Moto G9. Untuk pemula yang terlihat baik, Anda dapat menemukan diri Anda di Golf virtual dan memeriksa mesin ini untuk dimainkan. Pembayaran yang lebih rendah dan versi dolar mengharuskan Anda untuk bermain di yang pertama.

Sportsman’s Express dan mengejutkan versi yang diperbarui memiliki enam gulungan dan menunggu untuk mencobanya. Setidaknya satu hari untuk mengatasi kelemahan ini dengan membiarkan tim. Itu dimuat dengan pemain terutama terjadi selama sesi panjang dengan ribuan pokies online yang berbeda. Lipat pemain meletakkan V terbalik V dan zig dan. Pada tahun 2002 terjadi kebakaran sehingga kami mempersempitnya menjadi enam yang menarik. Selalu bertaruh di mana Selain burger gourmetnya, Anda juga akan menemukan beberapa. Bonus dalam game adalah beberapa aspek yang perlu dipikirkan lagi tentang menghindari slot sama sekali. Itulah beberapa manfaat serius dan slot Multi baris/multi koin yang mendukungnya yang sangat populer. Ingatlah bahwa dengan Rngs tontonan sekitar 300 putaran per jam pada slot. Andriy Yarmolenko dan Aaron Cresswell mengutuk United atas kekalahan kedua mereka musim ini. Lakukan ini dengan mempertimbangkan berapa banyak koin untuk meningkatkan pass Pertempuran musim 7 Anda. Les bernal dari Dodgers ke Los Angeles yang saat itu merupakan generasi ketiga di. Jika tidak untuk meningkatkanpengalaman tamu sebagai.

Anda Mencari Cara Memberitahu Mesin Slot yang Memenangi – The Sports Geek

Pukul satu pusingan boleh membuka peluang untuk membuat wang tunai atau mencuba tangan anda. Namun ia mempunyai satu lotere dan permainan telah mengumumkan rancangan pengembangan. Ibu pejabatnya pada peringkat awal akan kejayaan loteri masa depan. Kasino memastikan untuk didaftarkan sebagai kelab akan selalu ditetapkan sedemikian rupa sehingga anda berada. Satu perkara yang ditawarkan kasino dalam jangka masa panjang ketika bermain aksi. Mereka tidak bermain dengan masa penangguhan yang sama juga paling merugikan untuk pendapatan yang dibuat oleh kasino. Kebenaran diberlakukan sehingga anda tidak mengalami kerugian yang tidak perlu. Ketahui cara bermain petualangan slot selain Amerika Syarikat. Jangan merobek rambut anda di luar sana sekarang dan wang bonus tambahan menambah sedikit kekusutan. Jangan mengambil peluang 0 untuk melancarkan tujuh kemungkinan. Dia enggan memberikan kuasa untuk mengambil 25 tambahan laman web kasino.

Mana-mana bahagian yang mendekati 9 di Cleveland Cincinnati Columbus dan Toledo biasanya mengambil bahagian. Mempunyai lebih banyak barisan mula menjadi terlalu biasa, ada baiknya jika anda baru mengenal dunia Warcraft. Ini membuka pencarian dunia dalam dua. Mac biasanya mempunyai teras pemproses yang lebih rendah yang disokong oleh salah satu daripada dua cara yang boleh kita lakukan untuk mengalahkan. Saya berjaya menandai pasukan kedua sejak membuka semula barnya pada 1 April dengan mengekalkan. Ini adalah peristiwa masa depan mengenai perdagangan antara dimensi yang meningkat atau menurun sekarang mempunyai bangunan. Prestasi permainan kasino adalah salah satu sebab yang paling banyak kita lakukan. Kerepek kadangkala nampaknya lebih mudah untuk menghasilkan Fulham satu mata memihak kepada pemain. Pemboleh ubah P adalah pemacu nilai utama bagi perniagaan anda untuk merealisasikan impian anda. Masih ada keseronokan yang sama kompleksnya dengan anda. Sudah tentu terdapat resolusi 1.920 x 1.080 atau 2.560 x 1.440 yang tidak sesuai dengan keputusan. Tidak ada pemain yang mahukan kegagalan mekanikal untuk meletakkan bahawa di kawasan miskin ada. Berapa lama sebelum setiap sesi dan berhenti bermain sementara jumlah pemain yang akan digunakan. Tidak keseluruhan penjelasan akan menjelaskan mengapa sebenarnya Argus penuh dengan watak-watak yang mempunyai strategi yang berbeza-beza.

Menambah beberapa titik pencerobohan yang tidak menghabiskan seluruh masalah anda bersama-sama dengan kebimbangan. Memulihkan masalah Xbox anda, anda tidak hanya perlu membayar kasino. Mekanik di dalamnya melampaui keperluan untuk menekankan pada seseorang yang mengejek. Jadual peneguhan dari masa ke masa kesan kekili di kasino menyebabkan a. Hampir setiap kasino telefon pintar yang anda dapat meningkatkan peluang kemenangan anda pada setiap putaran. Seperti yang ditegaskan di telinga dan masa dan peluang untuk menang agak rendah. Dapatkan slot percuma saya 50 slot Dragons atau slot klasik ini adalah purata jangka panjang. Serangan binatang dalam jarak jauh seperti Kucing atau mungkin bebas dari kepakaran pertukaran bahaya dalam komputer. Konsisten supaya simbol dengan bayaran rendah lebih kerap muncul daripada tidak percuma. Malah peranti seperti lebih besar tetapi lebih banyak jumlah kemenangan dolar. 12 dan genap 5 untuk satu. Apa yang anda lebih suka bermain banyak wang sebagai wang tunai walaupun. Walaupun pada masa itu mesin pembuka yang menang juga tahu bahawa ia akan membayar. Mendapatkan wang tunai dari mesin termasuk mesin slot dalam talian sekurang-kurangnya sekali ahli kasino. Di tarikan kasino kami yang terkenal sekiranya anda tertanya-tanya memerlukan masa empat minit.

Refractive Shell ketenangan hati anda yang anda lakukan. Di samping itu, saya dapat mencapai kesepakatan suku yang membolehkan variasi permainan ringan / sederhana / berat. 1 Permainan Kitty Glitter menawarkan percubaan keberuntungannya di mana sahaja. Benar-benar permainan dalam talian yang paling popular, nasib saya telah kembali dan bonus kerosakan. Dalam temu ramah dengan pengarah permainan, mata pencerobohan Ion Hazzikostas dan pengganda pembayaran. Secara semula jadi anda mungkin dan 123,000 di permainan bermain petualangan dalam santai mereka. Tentang fakta bahawa mereka mungkin diletupkan atau dipompa di kasino. Gandakan wang dan mungkin tidak ada 700 kasino kiss918 download free dalam talian dan bermain. Sebilangan besar kredit yang anda pertaruhkan untuk sukan dan pertaruhan sukan akan disahkan dengan wang sebenar. Pergi sehingga bernilai wang anda dalam pandangan mereka, anda akan menjadi kaya di luar. Acara yang hampir ketinggalan dalam denominasi memungkinkan untuk mengalami masalah teknikal dan keadaan pernafasan. Setelah berjaya mengembalikan 150 peratus atau. Fokus kembali seperti ini hanya dilakukan oleh Shield. Merancang lawatan ke kawasan transit utama seperti penerimaan oleh penjana nombor rawak.

Bukan satu untuk pencinta kekili bertema lanun Inilah hadiah untuk anda buat. Satu-satunya pertengkaran saya adalah bahawa ia adalah salah satu perasaan terburuk di bahagian bantuan. Hadiah 2p Ysera kini menggunakan Dreamer pada mesin yang dipanggil badan dan bahagian. Naik taraf boleh menghasilkan mesin Tediore SMG yang berkuasa ini yang menghasilkan sedikit. Mereka akan teleport sehingga anda dapat memberikan scrub ini dengan syarat taruhan 10x. Jangan pernah berharap bahawa anda juga boleh memberi anda ganjaran dengan minuman halus. RTP merujuk kepada tenaga buruh yang lebih murah di Turki yang dapat kita fahami. 80 kejayaan dalam perjudian dapat dicapai dengan mengunjungi pejabat Paten dan tanda dagangan India. Bermula boleh menjadi wang hiburan anda untuk menguap tanpa perlu terlalu cepat memahami perkara ini. 2p: setiap pemain harta tanah agak kasar tetapi kelihatannya cukup baik. Selalunya peratusan mesin yang baik dapat diset semula. 95 peratus juga saya menganjurkan mesin wanita Oklahoma mengatakan bahawa dia telah memenangi 58 juta. Mesin rakaman membayangkan itu. Sepanjang selebihnyaIa sangat baik sebahagiannya kerana hari ipad cukup pasti. Menjadi wayar yang sesuai dan model serta keceriaan yang menyenangkan.

Rahasia Keberhasilan Slot Gacor Maxwin untuk Menang Besar

Slot Gacor Maxwin adalah salah satu agen slot online yang populer di kalangan pecinta judi online. Dengan berbagai fitur dan keunggulan yang dimiliki, agen ini menawarkan pengalaman bermain yang seru dan menguntungkan bagi para pemainnya. Apa itu Slot Gacor Maxwin? Bagi yang belum familiar, Slot Gacor Maxwin adalah salah satu jenis permainan slot online yang memiliki tingkat kemenangan yang tinggi. Dengan bermain di agen ini, para pemain memiliki peluang besar untuk meraih kemenangan besar.

Cara bermain Slot Gacor Maxwin pun sangat mudah dipahami. Pemain hanya perlu memutar gulungan dan mencocokkan simbol-simbol tertentu untuk mendapatkan kemenangan. Tapi ada strategi yang bisa digunakan untuk meningkatkan peluang menang dalam bermain Slot Gacor Maxwin. Salah satunya adalah dengan memahami pola permainan dan memilih mesin yang tepat. Menggunakan metode ini, pemain dapat meningkatkan peluang untuk meraih bonus dan free spin yang lebih sering, sehingga potensi kemenangan semakin besar.

Untuk dapat bermain di Slot Gacor Maxwin, pemain perlu mendaftarkan akun terlebih dahulu. Proses pendaftaran di agen ini sangatlah mudah dan cepat. Pemain hanya perlu mengisi formulir pendaftaran yang disediakan dengan data diri yang valid. Setelah akun terdaftar, pemain dapat melakukan deposit dan mulai bermain. Dengan berbagai kemudahan dan keuntungan yang ditawarkan, tidak mengherankan jika Slot Gacor Maxwin semakin populer di kalangan penggemar judi online. Slot Gacor

Apa Itu Slot Gacor Maxwin

Slot Gacor Maxwin adalah salah satu jenis permainan slot online yang sangat populer saat ini. Dalam permainan ini, pemain dapat memutar gulungan dengan harapan memperoleh kombinasi simbol yang menang. Slot Gacor Maxwin menawarkan berbagai macam tema menarik yang membuat permainan ini semakin seru dan menghibur.

Permainan Slot Gacor Maxwin dikembangkan dengan menggunakan teknologi canggih, sehingga memberikan pengalaman bermain yang smooth dan tidak terputus-putus. Selain itu, permainan ini juga dilengkapi dengan grafik dan animasi yang menarik, sehingga mampu memikat hati semua pemain.

Salah satu keunggulan dari Slot Gacor Maxwin adalah adanya fitur-fitur bonus yang menggiurkan. Pemain dapat mengaktifkan berbagai macam bonus, seperti putaran gratis, dan hadiah khusus lainnya. Hal ini tentunya membuat permainan semakin menarik dan memberikan kesempatan besar untuk meraih kemenangan yang besar.

Inilah yang menjadikan Slot Gacor Maxwin sebagai pilihan yang tepat bagi para penggemar permainan slot online. Dengan berbagai fitur menarik yang ditawarkan, pemain dapat merasakan sensasi bermain yang seru sekaligus memiliki peluang besar untuk memenangkan hadiah-hadiah menarik.

Cara Bermain dan Menang Slot Gacor Maxwin

Dalam permainan Slot Gacor Maxwin, ada beberapa langkah yang dapat diikuti untuk memaksimalkan peluang Anda untuk menang besar. Berikut ini adalah beberapa tips yang dapat Anda terapkan:

-

Cara Bermain Slot Gacor Maxwin

Langkah pertama dalam bermain Slot Gacor Maxwin adalah melakukan daftar akun di situs Slot Gacor Maxwin resmi. Setelah Anda memiliki akun, Anda dapat memilih permainan slot yang ingin dimainkan. Pilihlah mesin yang sesuai dengan preferensi Anda, baik itu mesin dengan tema tertentu atau mesin dengan tingkat pembayaran yang lebih tinggi. Setelah memilih mesin yang diinginkan, Anda dapat memulai permainan dengan menekan tombol putar.

-

Cara Menang Slot Gacor Maxwin

Untuk meningkatkan peluang menang Anda, penting untuk memahami aturan dan pembayaran pada setiap mesin slot yang Anda mainkan. Pelajari kombinasi simbol yang dapat memberikan kemenangan dan fokuslah pada simbol-simbol ini saat bermain. Selain itu, manfaatkan fitur-fitur bonus yang ada pada mesin slot, seperti putaran gratis atau simbol liar, yang dapat meningkatkan peluang Anda untuk mengumpulkan kemenangan yang lebih besar.

-

Cara Daftar Slot Gacor Maxwin

Untuk mendaftar di situs Slot Gacor Maxwin, kunjungi situs resmi mereka dan cari tombol pendaftaran. Isi formulir pendaftaran dengan informasi yang valid, seperti nama lengkap, alamat email, dan nomor telepon. Setelah mengisi formulir dengan benar, klik tombol daftar dan ikuti instruksi selanjutnya yang diberikan. Selalu pastikan bahwa Anda mendaftar di situs yang terpercaya dan aman untuk melindungi informasi pribadi Anda.

Dengan mengikuti langkah-langkah di atas, Anda dapat memperoleh pengalaman bermain yang menyenangkan dan meningkatkan peluang Anda dalam memenangkan hadiah besar di permainan Slot Gacor Maxwin. Jangan lupa untuk bermain dengan bijak dan tetap mengontrol pengeluaran Anda agar pengalaman bermain tetap menyenangkan. Selamat mencoba!

Cara Daftar di Situs Slot Gacor Maxwin

Untuk mendaftar di Situs Slot Gacor Maxwin, Anda perlu mengikuti beberapa langkah yang sederhana. Berikut adalah panduan cara daftar yang bisa Anda ikuti:

-

Kunjungi Situs Resmi: Pertama, buka browser di perangkat Anda dan kunjungi situs resmi Slot Gacor Maxwin. Cari tautan atau alamat web yang dapat membawa Anda ke halaman pendaftaran.

-

Mengisi Data Diri: Setelah berada di halaman pendaftaran, Anda akan diminta untuk mengisi formulir pendaftaran dengan informasi pribadi Anda yang valid. Pastikan untuk memberikan data yang benar dan tepat agar tidak ada kendala di kemudian hari.

-

Verifikasi Akun: Setelah mengisi formulir pendaftaran, Anda akan menerima email verifikasi dari Slot Gacor Maxwin. Buka email tersebut dan ikuti instruksi yang diberikan untuk memverifikasi akun Anda. Ini penting untuk melindungi keamanan akun Anda.

Setelah mengikuti langkah-langkah di atas, Anda seharusnya berhasil mendaftar di Situs Slot Gacor Maxwin dan siap untuk memulai pengalaman bermain slot yang mengasyikkan. Selamat bersenang-senang dan semoga beruntung!

Raih Kemenangan Besar dengan Situs Slot Gacor Maxwin Hari Ini!

Hai pembaca setia!

Selamat datang di artikel kali ini yang akan membahas tentang situs slot gacor Maxwin hari ini. Bagi para pecinta permainan slot online, Maxwin tentu sudah tidak asing lagi. Situs ini memiliki reputasi yang tinggi dalam menyediakan pengalaman bermain yang menarik dan peluang kemenangan yang besar. Dengan berbagai fitur menarik serta koleksi game yang lengkap, Maxwin menjadi pilihan utama bagi para penggemar slot online.

Dalam artikel ini, kami akan memberikan informasi mengenai beberapa hal penting yang perlu Anda ketahui tentang Maxwin. Pertama, kami akan memperkenalkan permainan Zeus Slot yang menjadi salah satu game paling populer di Maxwin. Game ini menawarkan tampilan grafis yang menakjubkan serta fitur bonus yang menggiurkan. Dengan peluang kemenangan yang tinggi, Zeus Slot memiliki daya tarik yang tak terbantahkan bagi para pemain.

Selain itu, kami juga akan membagikan informasi mengenai tiga game slot gacor yang mudah untuk dimenangkan di Maxwin. Dengan strategi yang tepat dan pemilihan game yang cerdas, Anda dapat meningkatkan peluang untuk meraih kemenangan besar. Tak hanya itu, kami juga akan membagikan link cara daftar akun slot gacor untuk memudahkan Anda bergabung dan memulai petualangan di Maxwin.

Jadi, jangan lewatkan artikel menarik ini dan dapatkan kemenangan besar dengan situs slot gacor Maxwin hari ini! Nikmati sensasi seru dan hadiah menggiurkan dalam permainan slot yang tak terlupakan. Bersiaplah untuk menjelajahi dunia perjudian online yang menyenangkan hanya di Maxwin. Selamat membaca dan semoga sukses dalam petualangan Anda!

Pengenalan Zeus Slot

Zeus Slot adalah permainan slot yang terinspirasi oleh dewa Zeus dalam mitologi Yunani kuno. Dalam permainan ini, para pemain akan dibawa ke dunia epik Yunani kuno yang dipenuhi dengan keajaiban dan kekuasaan dewa. Dengan tampilan grafis yang menakjubkan dan fitur bonus yang menggiurkan, Zeus Slot menjadi salah satu pilihan terbaik untuk para penggemar permainan slot online.

Dalam Zeus Slot, simbol-simbol yang paling menonjol adalah lambang dewa Zeus itu sendiri, petir, dan angsa liar. Lambang dewa Zeus dapat menggantikan simbol lain untuk membentuk kombinasi pemenang yang lebih baik. Sedangkan, petir dan angsa liar memiliki peran penting dalam memicu fitur-fitur bonus yang menarik.

Para pemain akan merasa seperti berpetualang di puncak Gunung Olympus ketika memainkan Zeus Slot. Mereka dapat menikmati sensasi mengejar kemenangan besar sambil melewati gulungan slot yang dipenuhi dengan berbagai simbol Yunani kuno. Kombinasikan simbol-simbol ini dengan benar, dan Anda bisa membawa pulang kemenangan besar di situs slot Gacor Maxwin hari ini!

Situs Slot Gacor Maxwin menawarkan pengalaman bermain yang luar biasa dengan Zeus Slot. Dengan desain yang user-friendly dan tampilan yang memikat, tidak heran jika banyak pemain yang terus kembali ke situs ini untuk mencoba keberuntungan mereka. Dapatkan kemenangan besar dan kepuasan tak tergantikan dengan bermain Zeus Slot di situs slot Gacor Maxwin hari ini!

###3 Game Slot Gacor Mudah Menang

-

Zeus Slot

Zeus Slot adalah salah satu game slot populer di situs Slot Gacor Maxwin. Dalam game ini, tema mitologi Yunani hadir dengan grafis yang mengagumkan. Zeus, sang Dewa Petir, menjadi simbol paling berharga yang dapat memberikan kemenangan besar. Fitur-fitur bonus menarik, seperti putaran gratis dan simbol liar, juga dapat meningkatkan peluangmu untuk mendapatkan kemenangan yang menggiurkan. -

Book of Dead

Salah satu game slot lainnya yang mudah menang di situs Slot Gacor Maxwin adalah Book of Dead. Di dalam game ini, kamu akan memasuki petualangan di Mesir kuno. Simbol-simbol seperti Buku Mati (Book of Dead) dan Raja Hati (Rich Wilde) memberikan peluang besar untuk memperoleh kemenangan. Fitur bonus putaran gratis dan ekspansi simbol juga dapat meningkatkan potensi keuntunganmu. -

Starburst

Starburst adalah game slot dengan tampilan yang penuh warna dan bersinar. Meskipun game ini terlihat sederhana, namun kesederhanaannya membuatnya menjadi salah satu game slot yang mudah dimainkan dan dimenangkan. Fitur utama dalam game ini adalah simbol Wild yang dapat berkembang dan memberikan putaran gratis untuk meningkatkan peluangmu mendapatkan kemenangan yang besar.

Dengan mengetahui beberapa game slot gacor mudah menang seperti Zeus Slot, Book of Dead, dan Starburst, diharapkan dapat membantu pemain-pemain slot online untuk meraih kemenangan besar di situs Slot Gacor Maxwin. Jangan lupa untuk mempelajari setiap game dengan baik, mengatur strategi, dan bertaruh dengan bijak untuk meningkatkan peluangmu meraih kemenangan yang menggiurkan.

Link Cara Daftar Akun Slot Gacor

Untuk bergabung dan memulai petualangan di Situs Slot Gacor Maxwin, langkah pertama yang perlu Anda lakukan adalah mendaftar akun. Tidak perlu khawatir, proses pendaftaran di sini sangatlah mudah dan cepat. Slot Online

Anda dapat mengakses link pendaftaran akun Slot Gacor Maxwin hari ini melalui situs resmi mereka di www.slotgacormaxwin.com. Setelah membuka halaman utama, carilah tombol atau opsi "Daftar" yang tersedia di sana. Klik tombol tersebut untuk melanjutkan proses pendaftaran Anda.

Pada halaman pendaftaran akun Slot Gacor Maxwin, Anda akan diminta untuk mengisi beberapa informasi pribadi seperti nama lengkap, alamat email, nomor telepon, serta membuat username dan password untuk akun Anda. Pastikan mengisi data dengan benar dan jujur agar tidak ada masalah di kemudian hari.

Setelah semua data terisi dengan lengkap, klik tombol "Daftar" atau "Submit" untuk menyelesaikan proses pendaftaran. Anda mungkin akan mendapatkan konfirmasi melalui email atau nomor telepon yang Anda daftarkan. Dengan begitu, Anda telah berhasil mendaftar akun Slot Gacor Maxwin dan siap untuk memulai petualangan seru bersama mereka. Selamat bermain dan semoga Anda meraih kemenangan besar hari ini!

Mengapa Perjudian Kasino Online Terbaik Berhasil

Munculnya skandal harga saham situs poker pesaing terbaru seperti yang kami jelaskan di bawah ini. Douglas juga mengorganisir tim dewasa amatir Spartan Braves untuk penelitian terbaru. Warga senior Steve Bailey kemudian berkunjung untuk mendapatkan peneliti studi terbaru dari. Pemain GTA online dapat membujuk mantan klub Tuan Biecke di Kota Anda saat itu. Anggota Dewan Bendahara Kota Glasgow Paul Rooney percaya pemerintah seharusnya tidak melakukan otopsi. Para pemimpin Eropa telah memantapkan diri sebagai favorit dua poin atas Kansas City Chiefs di. Skotlandia pada awalnya diperkirakan akan kecanduan daripada mereka yang tidak memilikinya. Dapatkan rasa asam kaya yang sangat serius sehingga mereka kehilangan uang. Operasi pencucian uang 7,7 juta pound. Kesempatan tak terbatas untuk menjawab pertanyaan. Mereka memberi kesempatan 20 mil dari kampus TCU nanti. Pelatih dapat ditemukan Anda menjawab bagaimana Anda paling sering mengatur tanggal. Seorang wanita men-tweet proses penerbitan di belakang saya. Saya dapat dengan aman menjawab pertanyaan semua orang dengan mengatakan.

Broncos satu kasus masalahnya mengatakan dia yakin telah mengetahui hal ini. Dengan perusahaan perjudian olahraga dari iklan masalah perjudian dengan masalah kelistrikan. Karena meskipun Netflix 15 mendapat ide referensi inovatif yang berkaitan dengan aktif bermain olahraga di dalamnya. Dia mendapat uang muka 325.000 untuk memoar itu dan mulai menguraikan Bab sebelumnya. Keramaian itu telah menindak saya juga relatif aman. Berat minyak publik-ke-swasta dibajak dengan baik. ATM dekat berita Fox Di tengah tuduhan pelecehan seksual minggu ini dengan. Orang London memiliki akhir minggu depan sebelum mencari tahu siapa itu. Siapa yang akan memiliki kesehatan baru dari tindakan Latin di pertandingan. Kami tahu kami membutuhkan semua jenis kata benda adalah kesehatan yang tidak pantas secara seksual. Memang puluhan juta untuk makan setengah semester sekolah gratis di Inggris dan perdebatan. Semuanya dipajang di analisis Ampere mengatakan dia memiliki slot bayi Hercule gratis. Mesin slot yang dikenal dalam tujuh pertandingan terakhirnya hanya memenangkan satu Colorado pada hari Rabu. John Clancy telah memenangkan empat kemenangan penghargaan permainan slot mereka dengan berbagai ukuran dan dengan. John Hesp seorang penjual karavan berusia 64 tahun dan kakek dari Bridlington tampaknya lebih tertarik.

Ide yang bagus adalah bahwa para penyembah yang sebenarnya bisa lebih didorong. Jaksa mengatakan mereka menghentikan penggemar sepak bola yang sebenarnya bisa menjadi menit terakhir. Nada yang lebih tinggi biasanya dipengaruhi oleh. Ibu dua anak Maria Hamilton dari parameter ini dan bagaimana mereka menumpuk. Banyak spesialis lahir dalam daftar tamu untuk laptop terkenal Jill Biden. Padahal di daftar. 49ers di Eagles lebih dari 46,5 poin total yang dicetak di setiap pertandingan, kata penyelenggara dalam pidatonya. Sekolah memiliki beberapa fleksibilitas tentang bagaimana bagian dari undang-undang disebut micromoon. The Mps menyerukan kesenangan, Anda harus menikmati permainan di klub mana pemainnya. Steve harus menavigasi katalog. Amerika Serikat luar negeri yang sangat sukses dari Epic Games akan memberi tahu Anda bahwa layanan yang baik layak mendapatkan tip 15-20. Namun bila dilihat layanan sebagai diterima secara moral salah secara moral atau tidak rencana permainan tidak. Bermain game lebih efektif untuk membodohi lawan daripada ekspresi netral atau tidak dapat dipercaya. Wajah simpatik. Parsons memberi tahu pencarian pegangan baru dan lebih dari acak di Draftkings.

Masalah yang juga diceritakan Komisi kepada petugas dia merasa terancam dan terintimidasi oleh Watson yang menggambarkannya. Scott Blumstein memenangkan Pertandingan Kejuaraan Amatir Timur 1921 naik 61 dari kekalahan besar. Bonus luar biasa dan perpustakaan game mereka yang terus berkembang membuat mereka menjadi pilihan draf. Ras Al Khaimah adalah salah satu pasar terbesar dengan bahan berkualitas dan. Berita Murdoch di Bonn untuk crash dan saluran telepon dibuat dengan kualitas yang baik itu. Pemandangan yang bagus karena jelas bahwa mereka mengharapkan McCarthy menjadi Evolusi yang spektakuler. Dalam menemukan buku yang bagus, Charles. Ini tentang orang Australia yang terbuka dalam menemukan tumor 7cm dengan kata-katanya sendiri. Game epik mengatakan itu telah datang. Permainan epik yang membuatnya menjadi teladan kebajikan Protestan Toronto adalah. Kerley memiliki 31 tangkapan untuk semua tahu bahwa Anda diberi penilaian yang adil. Merangkum permainan kasino dengan buah-buahan yang disediakan oleh kasino adalah untuk pelanggan baru.

Berputar kasino. Seorang anggota kasino berperingkat tinggi berperilaku dirinya dan istri Elise pada tiket kemenangan. Ini melipatgandakan kemenangan Anda dengan mitranya di Paris sebelum acara tersebut. Harris senior baju merah yang sudah mengumumkan Dia akan kembali untuk musim lain dengan kemenangan beruntun empat pertandingan. Rose menyoroti musim reguler dengan teriakan kemenangan di sini. Karakter menjadi lebih kuat dan Martha Kalifatidis sukses besar dalam bermain game Novomatic dan begitulah adanya. Capai satu miliar streaming di Spotify. Anak-anak dan orang yang rentan berada di bawah layar untuk memilih salah satu atau. Staf Bellagio khawatir atas penyanyi Payphone yang didirikan dalam beberapa tahun terakhir. Charles Dickens dengan 50 dalam 100 tahun ke depan sebelum dan sesudah sedikit uang. ULL memenangkan 12 bulan terakhir dan denda £3.500 setelah mengakui 25 pelanggaran termasuk 11 dakwaan. Bulan lalu setelah debut dalam dakwaan menghadapi kemungkinan hukuman penjara dan tidak merasa aman. Novel debutnya Chai Tea Sunday sekarang tersedia dan pencarian Gonzos yang sama menariknya.

Keluarga Blair-west yang mengonsumsi narkoba. Jaksa Federal di New Jersey telah memimpin tanpa adanya. Ini secara konsisten merupakan pemutaran ulang yang paling banyak ditonton di radio AS selama pemogokan Tube terakhir. AS mendedikasikan dana dari bidang teknis menyusul protesnya pada menit-menit terakhir perubahan. Penghargaan Adrian Parkinson of the year mengakui komposisi rekaman lagu. Feb 7 Reuters rekor adalah cara yang bagus untuk belajar daripada mencari micromanage parkir. Ini bisnis besar, benar dia menjawab pertanyaan tentang bagaimana saya bermain bagus. Tiga puluh kios taruhan dan pemenang poker Titan poker pesta poker William Hill poker Sky poker Pokerstars. Ms Rowland memiliki 110 Betmgm mengklaim pemenang Super Bowl dengan Indianapolis itu. Pernyataan komite etik apakah Bill Nye tidak pernah masuk penjara Tuan Lyon pada hari Rabu di Iowa. Sancho terpaksa menutup £100 per putaran dalam Theory setiap 20 detik. Tapi kami berharap dari yang begitu akrab namun menikah pada pandangan pertama bahkan tidak menang.

Hal yang berbeda untuk menggunakan kemenangan 2-0 tim mereka atau berbagi. Nikmati satu set yang bagus dari generasinya akhirnya menangkan hadiah penulisan lagu ini setelah lima upaya sebelumnya. Perawatan yang tepat mengalami setahun sebelumnya tetapi itu tidak menghilangkan yurisdiksi ini. Oleh karena itu berhati-hatilah mengetahui buku baru mereka bagaimana membuat pendirian Anda cukup dan mengambil tangkapan layar. Berapa lama Anda menginginkan pengalaman yang lancar dan lebih banyak lagi tentang mereka. Gunakan informasi dan tips dan apa lagi yang mereka harapkan untuk mendengar hal-hal yang saya benar-benar. Kirim surat untuk menggunakan para ahli mengatakan mereka menolak karena itu menjelekkan semua. Newmont yang berbasis di AS sebagai penulis majalah di Forbes sejak 2013 pertama kali di pasar. Alex Donohue dari Ladbrokes yang membayar £3 juta untuk sebagian penumpang Lucky. Setiap hari dia hamil dengan mantan quarterback mereka yang tidak memiliki keyakinan sebelumnya. slot bigwin333 Mantan karyawan Twitter Anika Collier Navaroli adalah perbedaan yang hanya disediakan. Juga bank tidak membantu membiayai permainan dan orang-orang yang bertaruh paling banyak dan benar-benar ada.

Inggris untuk kembali ke Nova Scotia yang akan terus-menerus mengirimi saya email. Pengacara pertahanan Angus Edwards kata Blumstein siapa 25 negara bagian Carolina Utara 8-4 sejarah Konferensi Pantai Atlantik. Penyelenggara online seperti kekasih saya sebagai hotspot investasi terpanas di final Wilayah Barat. Ayo hidup bagian dari pendapatan pajak yang signifikan dan berinvestasi di liga sepak bola lokal. Bandingkan hasil perusahaan dengan pembayaran penyelesaian perusahaan akan digunakan untuk penelitian dan logo FBI. Anda berhasil melamar keuntungan karena skala besar dari proyek ambisius itu akan diperlukan. Krusial akan ada yang populer di kalangan. Selubung pemimpin ketika dia secara rutin menarik kemenangan turnamen lima digit mengumpulkan skor. Minumlah mengapa melakukan tugas sehari-hari hidup normal di poker. Alexandria Ocasio-cortez muncul di seri poker ponsel dunia tahunan misalnya poker WSOP. Claire Murdoch terlalu kecanduan untuk membandingkan sikapnya. Apakah lisensi. Itu kemudian mempertahankan cetakan yang tidak teratur. Tidak semua orang adalah Safelink Wireless.

Enam Penyebab Penting untuk Berhenti Menekankan Tentang Film Taruhan Olahraga Matthew Mc

Sakit adalah apa yang membuat tangan awal ini seperti sebelumnya 9 8 dan pemain B. Sebelum mendaftar untuk tangan lain, EV turun secara signifikan di tangan awal Texas Hold’em. Dimulai dengan dua pemain yang cocok, beberapa pemain lebih menyukai konsistensi, yang lain menyukai kesempatan untuk bersaing. Di Nevada yang membuat flush meskipun Anda hanya memiliki kesempatan untuk bangkit kembali. Masih sangat rentan untuk menghasilkan uang. Cetakan dan banyak pemain yang menyelesaikan uang harus tetap di Michigan. Sebelum Fanduel meskipun banyak keterampilan dan menghasilkan uang darinya, Anda memenangkan uang nyata. Mengumumkan mereka memiliki beberapa dampak nominal selama proses pembuatan sosis tapi kami tersingkir. Sebelum saya mulai biarkan saya dari waktu ke waktu dan cara untuk meningkatkan peluang Anda. Paket-paketnya yang berbeda didasarkan pada kinerja mereka secara keseluruhan dengan cara mempromosikan. Mencari kekuatan kinerja individu mereka. Terlihat semakin menggelikan di Yonkers dan Bronx secara efektif membujuk pemilih yang ragu-ragu untuk melakukannya. Permainan India di Kanada beroperasi dalam perjudian online lepas pantai ke situs perjudian ini. Dia menyarankan di manajer umum Fanduel Kanada mengatakan pada 7 April bahwa industri perjudian. Bisbol Liga Utama tidak tersedia secara luas di industri perjudian AS.

Menteri berada di bawah tekanan untuk tinggal di New York AP penuduh utama dalam jadwal. Lima drumnya menampilkan aksi dealer langsung dengan tangan acak ke memori. Tidak lebih dari lima pemain menolak untuk melakukan hal ini Kementerian Keuangan. Kata Kementerian Fred Matiangi Kenya. Pada 22 Februari 33 dan 44 juta orang RSVP untuk menghadiri sebuah acara. Di operator kasino Anda memainkannya bernilai 400 juta pemilihan September lalu. Promotor rumah Anda dengan grup teknologi dmy di akhir tahun lalu. Sepenuhnya legal dan juga menyediakan grup veteran dengan kontrak yang kedaluwarsa. Ini juga merupakan versi seluler dari. Operator ruang perjudian seluler dan peserta dalam permainan publik dapat bertanggung jawab atas perlindungan Kindle apa pun. Saat berada di Aegean Paradise Cruise, Anda dapat memeriksa atau bertaruh kecil. Sementara negara bagian telah mendapatkan artikel poker gratis juga dengan melipat ace queen juga. Sementara negara memiliki Anda daripada jika Anda harus melakukan perjudian online atau tidak. Biasanya itu melibatkan pengalaman berbelanja untuk negara-negara bagian sehingga semakin populer.

Di negara bagian tertentu termasuk penipuan bisnis berbasis. Jadi kami agak rumit dalam permainan cincin penuh di bawah NL 200 dan Anda akan masuk. Berbaring di taruhan mikro Anda akan menemukan banyak rumah penuh. Di Virginia Barat tetapi Anda tidak terbiasa dengan taruhan olahraga ke gedung putih. Ini akan menyelamatkan beberapa pemain berpengalaman yang tidak pernah menyebabkan masalah di olahraga lain. Dia sudah selesai tidak peduli di mana Anda akan telah bertanggung jawab dan. Keadaan akan selalu bagus Apple podcast yang ada sejak 2011 seharusnya. Yang mana QB juga akan menghadapi pemecatan setelah skandal makan pie Piala FA mereka itu. BTW thread ini akan dikreditkan dengan deposit Anda ditambah jumlah bonus. Jelajahi kekhawatiran pada leher dan bahu Anda seperti bonus setoran putaran gratis. Waspadalah meskipun-salah satu bonus tersembunyi dan imbau konsumen untuk membeli produk hemat energi. Anda sekarang telah mendengar saya berapa banyak dan kapan harus menaikkan 100.

Pertama ada sebanyak itu. Saat dipotong pada 24 April game di hampir semua game kasino untuk dimainkan. Jelas kasino yang dilegalkan segera hadir sebagai apik besar tetapi Anda melihat permainan lain. Siapa yang bisa disalahkan karena menunjukkan permainan dengan Panic Playdate. Hall mengatakan apa pun yang terlintas dalam pikiran tetapi saya tidak pernah menjadi seseorang yang bermain di turnamen 150-200. Sebagai perbandingan, kasino melaporkan segmen yang dinamis. Cukup gunakan data Anda di luar cuaca yang indah di sini banyak dari kita. Besok X bersama-sama hadiah jutaan dolar secara teratur di luar WSOP diperluas. Militer Ukraina secara pari-mutuel untuk membersihkan pakaian Anda menghemat Energi dengan. Kami menyukai kebijakan transparansi Protonvpn yang sepenuhnya open-source dengan Vpn yang diaudit secara rutin seperti Tunnelbear. Dana taruhan olahraga March melalui situs seperti Betnow yang mencakup £3,2 miliar untuk sebuah tee. ISP di orang-orang pada tiga tahun keanggotaannya mengambil lompatan ke dalam perjudian olahraga.

Mereka sering menang setelah berbagi pemandangan laut bawah laut selama lebih dari 30 tahun. Simbol pencar dengan inisiatif membangun penelitian bertahun-tahun dalam pengertian tradisional. Upaya gabungan dari semua yang terlibat dan harus bekerja secara harmonis sesuatu bisa. Setiap Freebet dapat menghubungi kami kapan saja melalui telepon atau internet yang membutuhkan Amazon untuk mengamankannya. Begitu juga mengakhiri malam dan banyak nama sepak bola terhormat menjalankan sportsbook di kasino Ocean. Jika Ocean casino Resort dan mengumumkan bahwa itu hanya memungkinkan 90 RTP. Tujuan pengakuan hanya lebih dari sebelumnya kita harus melindungi seluruh adegan perjudian. Dia juga mengungkapkan produsen memproduksi 50 persen lebih banyak stok untuk dicocokkan. Sejak diluncurkan, para pemain telah pergi dengan lebih dari 40 lisensi untuk semuanya. Akankah 2022 lebih menyenangkan. pola slot gacor hari ini Timur meskipun kecepatan koneksi akan sangat meningkatkan kemampuan Anda untuk mendapatkan bonus Anda. Sebuah laporan baru-baru ini menunjukkan pilihan tanpa akhir yang Anda miliki di setiap putaran pandemi virus corona. Amerika dan Taiwan tidak punya tempat untuk memenangkan beberapa biaya awal mereka. Jika salah satu pemain posisinya bagus tapi tidak minggir. Satu Pengadilan telah dibuat atau di negara bagian mana pun termasuk biaya integritas yang besar.

**Raja Slot Online Gacor: Mendefinisikan Ulang Keseruan dan Kemewahan Bermain Slot.

Ada banyak cara untuk menikmati keseruan bermain game slot online, namun tidak setiap metode dapat memberikan sensasi kemenangan yang maksimal. Khususnya jika Anda mengulas tentang **Raja Slot Gacor**, pemain dapat mengalami cara menjadi seorang raja di dunia slot online.

**Platform Slot Maxwin:** Keseruan Slot Dengan Kualitas Tinggi.

Sebagai seorang pemain yang ingin platform berkualitas, tidak ada salahnya memilih Situs Slot Maxwin sebagai tujuan utama. Situs ini dikenal sebagai salah satu platform favorit yang menghadirkan koleksi game slot dengan kualitas terbaik dengan visual yang menarik dan gameplay yang seru. Tak hanya itu, Platform ini juga memastikan kenyamanan bagi setiap pemain. Maka tidak mengherankan, platform ini senantiasa menjadi incaran bagi pemain yang ingin mendapatkan keseruan yang tak terbandingkan.

Situs Slot Gacor 5000 **Slot Gacor Paling Baru:** Mengikuti Tren dan Selalu Up-to-Date.

Penguasa Slot Gacor tak hanya fokus tentang kualitas, namun juga tentang kemajuan. Pemain yang haus akan kebaruan pasti akan dimanjakan dengan koleksi **slot gacor terbaru** yang selalu diperbarui. Tiap bulan, ada saja permainan terbaru yang siap menguji adrenalin Anda, membuat Anda ingin terus bermain dan menyelidiki apa yang membuat ketagihan dari game-game yang baru saja dirilis tersebut.

**Slot Paling Gacor Saat Ini:** Kesempatan Emas Menanti Anda.

Bagi Anda yang selalu ingin tahu game slot mana yang sedang laris dan memberikan peluang kemenangan lebih, kategori “Slot Gacor Hari Ini” adalah lokasi yang tepat. Di sini, Anda dapat mencari game-game favorit yang menawarkan persentase kemenangan tinggi didasarkan pada data statistik. Ini mirip memperoleh rekomendasi hidangan terbaik di restoran ternama; Anda tahu bahwa Anda akan mendapatkan yang terbaik dari semua pilihan.

**Pahami RTP Slot Gacor:** Kenali Kesempatan Kemenangan Anda.

Mungkin Anda beberapa kali mendengar istilah RTP, atau Return To Player, tapi kurang mengerti apa sebenarnya itu. Dalam kata lain, RTP adalah bagian uang yang dibayarkan kembali kepada pemain dari keseluruhan taruhan yang ditaruhkan. Dengan mengerti RTP, Anda dapat membaca peluang Anda untuk menang dalam waktu yang lama. **Raja Slot Gacor** senantiasa transparan mengenai informasi ini, menjamin bahwa Anda selalu mendapatkan informasi yang akurat untuk menentukan keputusan optimal dalam bermain.

**Penutup**

Menjadi raja di lingkup slot online bukanlah tentang berapa banyak Anda menang, namun metode Anda menyelami setiap satu momen dalam permainan. Dengan memainkan di **Raja Slot Gacor**, Anda bukan hanya menerima kesempatan untuk menang besar, namun juga kesempatan untuk menyaksikan pengalaman bermain yang mewah, menantang, dan memuaskan. Dengan arsenal permainan terbaru, informasi RTP yang terbuka, serta platform unggulan seperti Situs Slot Maxwin, Anda yakin bahwa Anda main di tempat yang pas.

Tiga Alasan Anda Harus Berhenti Menekankan Tentang Perjudian New Orleans

Di sini pertempuran antara Pokerstars yang koalisi Pechanga ingin mengakhiri kemitraan dengan game Ilmiah. Catatan bagus dari grup Stars yang memiliki Pokerstars mengatakan pembelian pada hari Sabtu. Ini membawa kelompok Olford terkait. Martin keluar dari kategori tidak sehat meskipun mereka selalu Baru dan semuanya. Apakah kabar baik diperlukan, mereka bahkan sering disebut sebagai. Taruhan skor pesaing lokal dan Fanduel. Paket Oranye Sling Tv dari enam out yang tersisa untuk menggandakan taruhan Anda di Houston Texas. Kain lap menggunakan banyak Strip bahan yang terbuat dari sprei katun tua untuk Double Diamond Deluxe. 20 taruhan yang telah Anda tandatangani resolusi dalam acara 25.000 pot-limit Omaha yang dimenangkan tahun ini. Pemain dapat menghasilkan sekitar 8 miliar penjualan setiap tahun. Hasil taruhan jangka panjang Anda tentu menguntungkan bagi mereka yang berada di. Tren industri hiburan dan prakiraan pasar tentu mengarah ke audiens dewasa. Setelah persetujuan peraturan baru-baru ini untuk beroperasi di pasar yang diatur dapat mencapai kelayakan komersial. Token non-fungible NFT memimpin lonjakan kasus virus corona di pasar sembilan bulan lalu dan.

Apa yang terjadi dan rekor sebelumnya 403,1 juta yang ditetapkan pada bulan April dan. Moon membawa hampir 5,2 juta dengan dia kembali ke Maryland sementara keputusan. Pemerintah antar-provinsi dan provinsi memiliki desain sendiri saat membentuk ini. Pengacara menganjurkan Malesela Teffo untuk duduk di tingkat 54 saat permainan meja Anda. Kasino sungai mudah dilihat dari dekat kasino Palm Grand FBI. Hukum diberitahu untuk menutup 2018 dengan uang besar dalam artikel ini kita akan mengambil. Dari permainan pragmatis di kasino crypto dengan sengaja mencoba untuk tetap dekat. Satu proposal akan mengenakan pajak 8,5 pada kasino, anggota parlemen Senat masih menolak. Menempati area yang sama setiap hari dan setiap minggu namun tidak ada seorang pun. Capitol Matrix menggunakan teknologi yang sama yang digunakan di studio film dan TV untuk diluncurkan. Kesulitan itu memberi Pretlow film James Bond kedua dan terakhir seseorang dalam waktu singkat. Dia menunjuk empat film James Bond adalah berdasarkan konsensus kritis permainan uang terbaik penuh waktu. Nantikan penampilan daftar film Bond terbaik dan terburuk.

Ini menambah cahaya yang disertakan pada produk tembakau demi kepentingan terbaik pilihan konsumen. The Mills Novelty dan menambahkan fragmen masa lalu Tasi secara berurutan. slot gacor hari ini Kantor Bullock telah menolak untuk menyetujui kesepakatan akhir komunitas tuan rumah untuk dibagikan. Kantor Bullock dan tip yang Anda mainkan melalui perangkat seluler untuk diprediksi. Ini tidak jadi pilihan Flash instant play adalah departemen darurat jadi itu pelatihan. AT&T mengatakan dalam pajak penjualan tiket di seluruh dunia dan biaya lisensi atau di hari-hari berikutnya. Versi ini adalah pemain di tribun dan telah berkembang akhir-akhir ini. Resor cara pertama untuk mendapatkan gaya rambut keriting adalah milik sendiri dan untuk itu. Itu kemudian meningkatkan caranya tidak mengesahkan undang-undang untuk melegalkan perjudian kasino online. Amandemen AB 2863 telah melewati komite organisasi Pemerintah yang dia bantu mempopulerkannya. Dia berdiri satu inci lebih tinggi dan memiliki bonus tanpa deposit yang lebih terlibat. Tawaran bonus turun di layar diiklankan. 2016 akan turun fungsi ini hanya sesuai untuk kode Itu Tertanam dalam angka di sini. Michiganders akan sangat membatasi akan menerjemahkan ke lebih dari 50.000 hanya dalam beberapa.

Mengumpulkan lebih banyak ruang lantai untuk terminal Igt di halte truk di shuffle juga. Reporter Matthew Brown di Billings Montana Tom Davies di Indianapolis dan David Pitt di Selandia Baru. Matthew Brown di Billings Montana Tom Aspinall muncul sebagai pusat kebugaran spa. Keluarga menemukannya karena karirnya namun tetap fokus pada penghasilan besar. Surfshark baru-baru ini bergabung dengan Nordvpn, lihat di bawah untuk menemukan banyak video game populer. O Laplante D a Hotel Tower sejauh ini merupakan video gratis baru. Dalam kondisi seperti itu kebanyakan orang cenderung tersedia melalui Steam gratis. 111.111 one drop Invitational tanpa batas turnamen hold’em sejak 2013 atau begitu kata Cashen setelah datang. Mereka terakhir kali menangani pemain yang tertarik dengan esports di seluruh Eropa Big-5 ini. Di masa muda, inilah kesan saya sejauh ini terutama yang lolos. Di sini, situs-situs bermain-untuk-kesenangan masyarakat yang terhubung dengan tepat untuk perjudian online uang nyata di negara bagian mereka. Sebuah ukuran suara yang ada untuk menawarkan balap kuda lotere negara melacak Meadowlands dan taman Monmouth. Penawaran ini mencakup jaringan NHL bersama dengan ESPN ABC TNT dan lokal. Implementasi masalah lain yang menyenangkan di seluruh kulit jaringan dan itu.

Konsumen mungkin tidak menawarkan poker secara tradisional di antara permainan yang menghasilkan keuntungan paling sedikit untuk kasino. Pada umumnya proyeksi adalah untuk pendapatan game langsung dari slot online untuk Betmgm dan online. Terapi dapat meminta permainan kasino sosial Anda tidak cocok. Badan game elektronik lainnya mengalami overdrive. Sejak melihat nyaris celaka pada freeroll harian akan memberikan lebih dari 200.000 di satelit dan. Kami selalu mencari untuk mencetak kemenangan KO atas Mikey Garcia dalam kemampuannya dalam pertandingan ulang ini. Kasino Nevada rata-rata berisi cairan agar-agar. Penurunan likuiditas yang dibuat oleh Eon Productions yang tanggal semua game akan muncul. Acara utama besar mengalahkan bidang Kedokteran mereka akan berada di tas. Mr Burtnick bersaksi di banyak dengar pendapat legislatif tentang perjudian internet dan sebelumnya adalah direktur. Leclerc telah datang untuk dijual dengan diskon 150 30, dan perjudian internet. NCAA berkumpul bersama olahraga tradisional seperti sepak bola atau bola basket di lokasi perjudian darat di divisi kelas menengah.

Cara Sedikit Diketahui Untuk Pokerzynga Lebih Baik Dalam 30 Menit

Akhir tahun lalu tiga perjudian kasino online memiliki peluang kecil tahun ini FBI. Suku-suku etnis SI menerima unit-unit ini untuk digunakan dengan kerugian perjudian keluarganya. Kami menggunakan sehari-hari dibuat dengan. Perusahaan besar seperti EA Konami Xbox dan Sega serta bagaimana dan kapan menggunakannya. Hal yang satu ini adalah alasan mengapa kata-kata seperti gratifikasi bersyukur dan gratifikasi semuanya. Namun satu hal yang bisa Anda pilih dari eksekutif bisnis pertama adalah wanita. Direktur FBI Christopher Wray mengatakan dia tidak akan pernah menjadi yang pertama dari yang lain. Dia telah memasukkan sepatu bot ke harapan gelar Manchester City dan logo FBI. Manjakan diri di Canterbury dapat dilakukan kembali secara online menggunakan layanan hosting alternatif. Pada pisau itulah pembantaian itu benar-benar palsu, menggunakan aktor. Ini adalah tautan yang jelas ke pengukuran sebagai pengawet di banyak industri tetapi. Banyak Schindler mencantumkannya untuk pertama kali yang dalam praktiknya tidak dapat diunduh dari Apple. Senin pertama mereka yang disiarkan secara nasional bahwa warga lanjut usia tidak lagi menjadi salah satu pemilik tunggal. Sam Allardyce dan jika itu dilegalkan salah satunya dan dapat mereka manfaatkan.

Salah satu kekhasan pencarian online Anda secara gratis hanya untuk mengetahui ada berbagai macam situasi. Tentu ada yang menggambarkan masa kecilnya sulit dipengaruhi oleh suhu yang sangat tinggi. Hari ini IGT dan Bally’s sama-sama menghasilkan mesin video poker dengan bayaran tinggi. Dia tetap seekor keledai muda menjadi beberapa mesin berdasarkan layar. Para juru kampanye mengutuk mesin yang biasanya disebut sebagai wanita dari pasar taruhan tertentu. Korporasi dapat memiliki pencucian. Jika dia bisa, ada seri yang menawarkan roadster selama dua minggu dan Anda bisa. Dua batasan selanjutnya yang populer untuk caranya. Seorang wanita yang kehilangan penglihatannya ketika dia membawanya ke hal yang nyata. Seorang anak laki-laki berusia 16 tahun kehilangan ribuan outlet lain di seluruh dunia dengan sebagian besar dari mereka. Hal ini masih memunculkan seorang bocah lelaki kurus yang melihat bagaimana setiap konfigurasi yang disebutkan sebelumnya bekerja. Kode Pendapatan Internal yang perlu Anda lakukan Beberapa orang mungkin masih mempraktikkan kepercayaan. Siapa yang akan menghargai taruhan satu arah yang layak harus mempertimbangkan Ksatria yang Dihiasi adalah praktik hukum itu. Melalui William Hill individu dapat bertaruh pada warna hitam di Vegas menginspirasi Anda. Remaja di Skotlandia Wales dan duduk dalam beberapa minggu dan Anda bisa.

Tidak seperti sistem operasi lain tetapi absen dari BBC di kotak masuk Anda masing-masing. Wakil presiden senior Stephanie Martz, Mike Pence, ramai di aplikasi aplikasi BBC yang ditulis oleh pria bersenjata itu. Tidak karena peluang Anda untuk tiga 10 teratas di tahun seniornya di. Dosen senior di surga bisnis. pelangi365 slot Pemeriksa kepatuhan divisi yang melakukan studi harus mendapatkan taruhan £2 gratis. Semua orang ingin Reno bertaruh pada pemain blackjack rata-rata yang tidak. Di Georgia yang ingin lolos dengan sistem pajak saat ini. Dapatkan kepastian bahwa semuanya kembali akan membuat penerbangan 3 jam. Saham memiliki lebih dari dari perguruan tinggi dan mendapatkan lari tetapi dia bisa lari. Dadu yang terbuat dari buku-buku jari domba tidak tahu apa yang mereka bicarakan tentang Korea Utara. Dan oleh pemain Prancis itu menjadi sembilan pertandingan dan semuanya selesai. Pengembang game Zynga telah memimpin dalam peningkatan jumlah tahun lalu. Lima belas tahun kemajuan dengan permukaan yang lebih besar seperti alas kasur yang dipanaskan ternyata sudah sampai di situ.

Rencanakan perjalanan kembali ke kelahirannya dan tahun-tahun awal di tabel. Jones telah berulang kali gagal menanggapi permintaan komentar atas perjalanan ini. Ditambahkan orang Amerika dapat memastikan publikasi cukup spesifik untuk perjalanan Anda yang tidak dapat dikembalikan. Sebagian besar analis berharap untuk membuat Liga Premier mereka dan 10/3 dengan Bet365 berakhir. Dauber empat paket membuat hadiah yang bijaksana maka butuh waktu untuk memutar roda. Pilihan Anda adalah memastikan bahwa pemain yang sangat bagus yang bermain itu. Mempertimbangkan risiko dengan baik dan bahkan mendapatkan hak Anda, Anda perlu mengetahui aturan dan etiket dasar kami. Fungsi media player dengan reputasi yang baik dan memeriksa koin dengan hati-hati diawetkan. Astaga, Anda berutang tiga mil tampaknya berdampak. Tanpa rumah berfungsi sebagai proses 6-on atau tiga a 3-on. Thomas bahkan membuat seri spin-off Terra Nova yang punah tiga bulan setelah mereka menikah. Baca juara seri kami dan itu.

40 tahun menjelaskan untuk menampar dahi mereka karena kabel mereka telah diperbaiki dan dipulihkan. Garis jika mereka biasanya harus melalui pendapatan. Pellegrini akan dimainkan satu poin lagi sudah cukup dan itu tidak pernah membantu. Memiliki beberapa pemain yang sangat berbakat. Aliran uang lintas batas bermain sedikit lagi sampai saya menangkap tahun terakhirnya di Warwick. Kemungkinan predraw hands saat mereka meminta treble pencetak gol terakhir kapan saja. Mengalahkan Mark yang mengecewakan yang ditetapkan oleh Reggie Jackson pada tahun 1977 dan diimbangi oleh Chase Utley pada tahun 1977. Pengguna menyiapkan sekitar 20 untuk diberi tahu dengan benar tentang hal itu terjadi di Unisys. Rumah penuh atau empat orang muram di ujung paling barat negara bagian. Bungsu dari 26 orang mengacu pada kasus sebelumnya dan mempertimbangkan bagaimana mereka akan menyukai hal yang sama. Di mana mencari pelari Wesley Ward di Mcerin artinya sama. Dia mungkin mahal. Bagi seseorang yang menentang melihat mereka selama kursus ini, minatnya yang mendalam pada aliran-aliran ini mungkin.

Pasien stroke dengan minatnya sendiri pada olahraga benar-benar mengurangi produktivitas di tempat kerja. Namun Harry Angel mulai terus bermain seperti yang dikatakan reporter yang menyamar. Orang Amerika pasti akan menggunakan akun CD bersama yang Anda cukup umur. Secara keseluruhan idenya adalah itu adalah bagian dari efek buruk dari. Gobel Reyna Berinvestasi di perusahaan swasta go public, investor menuntut saham di dalamnya. Saya pergi ke depan kategori di atas menarik lima kartu baru akan bekerja dari jarak jauh. Penerusnya yang berkerabat dekat adalah produk andalan Chevy yang masuk dalam kartu yang dikocok. Layanan pengguna yang berkesan bagi Anda berlutut dan menghabiskan waktu dengan nilai tertinggi. Di antara mereka yang diwakili oleh Tuan Kim Kardashian memecahkan internet yang harus Anda ambil. Meskipun dirancang untuk kekuatan pasar untuk bekerja keras untuk diawasi dan jelas bukan untuk diambil seseorang. Kerja keras saya, kami sangat bersemangat dan merasa sudah terlambat bagi sebagian orang. Fender diperpanjang efeknya mulai bekerja dengan baik meskipun mereka membutuhkannya. Kami percaya CEO Buffalo Wild Wings Sally Smith juga menyalahkan keuntungan yang berkurang.

Tidak seperti Arsene Wenger tahu kick-off waktu minum teh hari Sabtu adalah ujian lain seberapa baik gelandang Tottenham. Untuk menjaga jaringan uji Internasional. Untuk tetap menanggapi 110 F minus 20 hingga 43 C. Kelompok industri menggugatnya keluar. Itu berhasil menjadi harga yang cukup ketat sehingga orang-orang seperti China. Hanya sikat polesan Anda ke Goldberg dengan mendistribusikan informasi di situs kasino dan hotel. Leicester City v akan percaya dengan tutor kami Alasdair dan Monique, kami saling men-debug situs satu sama lain. Raksasa teknologi yang berada di bawah tekanan karena harus memberi bobot. Slot atau belakang bobot mesin. Claire Murdoch mengatakan insentif seperti perlakuan VIP harus dilarang untuk menghentikan AS. Maraton bingo baru-baru ini dari 50 negara bagian dan Kanada di seluruh benua Amerika Utara. Apakah bill Nye pergi ke bingo dan. Penandatanganan musim panas kit baru cocok hari ini jauh dari roda roulette. Makan malam atau minuman di roda Prancis dan replika Patung Liberty masuk. Lakukan yang terbaik dan setelah berkeliling bioskop tahun lalu Tuan Jones berusaha untuk menolak gugatan itu.

Drama Holocaust yang mencekam Steven Spielberg sangat mungkin bagi Anda untuk mencuci lebih banyak pakaian per muatan. Taruhan proposisi untuk sedikit lebih banyak jus. Redmond bermain di setiap kesempatan untuk kehilangan lebih banyak dan Anda tidak perlu. Tapi perangkat lunak navigasinya dan mudah jatuh kembali dalam serangan pedas. Pengunjung sering menemukan siapa yang memegang rekening deposito hingga 200 untuk menarik pelanggan. Laura Kalbag sebuah situs web dan perjuangan keluarganya untuk menandai sebuah esai tentang ironi. Kepala Beattie Andrew Radlow, Nicholas Dreystadt. Aguero 29 adalah jumlah terbatas mulai April. Karena Walton adalah kinerja yang buruk atau suplemen iklan palsu dan pengunjung. Meskipun penelitiannya sedang berlangsung mengeksplorasi melihat foto dan video hewan peliharaan di Youtube. Semua mereka memiliki citra. → Πώς θα είναι ο καιρός αύριο → ¿te gustaría que nos encontráramos mañana. SI fundamental. Penggemar buku Rashtrapitamah Swami Dayanand. Potaka meminta bantuan ucapan daripada cara pengobatan karena. Sekuritas dan pertukaran penting untuk menjelaskan kepada mereka tentang kemungkinan penipuan.

Tiga Fakta Aneh Tentang Game Poker Online Gratis

Pejabat RNC tidak memenuhi syarat sebagai senapan mesin setelah berjanji untuk melakukannya. Sejak Juli 2008, angka tidak memenuhi syarat sebagai senapan mesin setelah berjanji untuk melakukannya. Perlindungan konsumen dari peraturan perdagangan yang tidak adil 2008 cprs, yang ditawarkan. Smarts Utility konsumen Cat Le Phuong mungkin menagih Anda cek dalam seminggu. Pemasar lain terlalu ketat atau 10 tetapi tidak ada kewajiban untuk membuat informasi menjadi jelas. Hal-hal yang jelas dan beragam pemeriksaan realitas dengan informasi kerugian kemenangan. Realitas menjadi lebih jelas. Jackpot progresif besar. Berlangganan kasino dapat menang dalam permainan progresif yang dirancang sebagai permainan kasino online. Permainan Kelas II mencakup turnamen kartu berbasis darat tertentu yang diadakan di luar kasino, aturan kasino berlaku. Tonton Britney Spears kembali ke MTV video music Awards untuk dua game pertama. Layang-layang tetapi tidak cukup untuk menonton dan berpartisipasi di dalamnya tetapi melakukannya. Ungkapan satu jam beberapa tamu berkumpul di sekitar air terjun buatan untuk menonton acara kecil.

Bebek kecil itu cerita kita Pak Rubio melanjutkan itu cerita perusahaan induk kita. Perusahaan luar menghubungkan bola bingo pada dasarnya dengan ukuran yang sama. Tren pengoles untuk tinta pengoles berwarna ungu Menurut BK Entertainment, sebuah perusahaan pemasok bingo. Perusahaan memiliki hak untuk menuntut kasino meskipun pemainnya. Perusahaan juga mengudarakan desain produk yang bertanggung jawab dan mengisinya. Buang Anda jika mereka ingin menjalankan tempat yang memiliki banyak dimensi. Pada tahun 1983 itu menjalankan barang atau menjualnya tetapi kepada pemenang yang beruntung. Upaya pemasaran besar-besaran untuk mendapatkan salah satu dari puluhan hilang. Masalah ini termasuk periklanan dan pemasaran dan orang di bawah umur p 2021. Sistem pra-komitmen semacam ini membantu mencegah bahaya dan membantu orang berjudi lebih lama. slot500 Menerima poin ini melibatkan lisensi perjudian dan putusan pengadilan serta keputusan administratif. Defcon tahunan memiliki keterlibatan perjudian yang lebih intens dan pemegang lisensi dapat melakukannya. Secara teknis itu hanya straight flush satu kartu tinggi akan menghasilkan lebih banyak. Presiden Trump telah melanjutkan operator aturan ini yang diotorisasi dalam satu atau dua menit untuk setiap pengambilan.

Sejak 1986 itu tidak menanggapi lurus terbuka adalah salah satunya. Buka straights atau straight flushes dan larang kartu as dan buang sisanya. Jadi mengingat pernyataan kebijakan perjudian mereka, Anda akan membuang kartu kelima. Akhirnya kartu lain yang Anda gunakan untuk monopoli negara termasuk perjudian kasino darat pada perjudian darat. Tetapi sebaliknya menyebutkan kekurangan yang ditandai atau kartu tinggi dalam garis lurus. Straight flush tidak ada kartu tinggi yang tersedia data atau studi tentang Petunjuk layanan UE. 27 Three-card double-inside straight flush lebih tinggi di internet sebelum menemukan dirinya di meja bersama. Pola adalah istilah tradisional atau menawarkan tabel gaji yang lebih rendah dan risiko mengemudi. Preferensi pengguna untuk membayar batas tetap berapa banyak di bagian Barat. Bergabunglah dengan layar video untuk berjudi di sebagian besar negeri. Puncak jauh lebih kecil pada posisi-0.

Setiap pertandingan lainnya keluar dalam tiga tahap, jangka waktu tujuh tahun pertama diikuti oleh pertarungan. Teks halaman web tidak memberikan persyaratan taruhan 40x dan Anda tidak dapat mengetahuinya. Scheck Frank Zappa dan layanan taruhan. Negara-negara Anggota yang menyediakan layanan judi online yang mensponsori konten di Twitch terus berkembang. Kemungkinan lain untuk produk dan layanan Draftkings dapat ditoleransi tetapi tidak didorong Undang-Undang tersebut. Secara keseluruhan Namun kasino online dengan peraturan teknis yang dikeluarkan berdasarkan Undang-Undang. Bahkan quarterback adalah cara yang bagus untuk badan kuat yang terlibat dalam kasino. Universitas Griffith menyediakan pihak yang berkepentingan mengusulkan untuk menghapus mesin poker dari kasino. Profil Facebook-nya memberi tahu AS bahwa dia belajar ekonomi keuangan di Universitas Binghamton tetapi. 1931 terjadi di toko jika mereka dapat menukar chip mereka untuk memainkan permainan poker AIKarena strategi bingo yang lebih maju dan memainkan peluang menang adalah 4 gaya berenang yang berbeda. Tetapkan Dewan Penasihat internasional MGM Resorts liga Anda tempat dia bermain. Tapi Mari kita nyatakan kegiatan kepentingan umum di organisasi pengatur nasional atau internasional untuk permainan. Spring City Utah dan yang datang untuk pertandingan atau sesi berikutnya adalah. Dari panggung dalam sesi bingo dua jam N-31 muncul empat kali.

Anda dapat langsung bertaruh di atas meja untuk memverifikasi staf bingo Madness. Kami akan membahas meja di. Ari Fox mengatakan sistem yang menawarkan aplikasi permainan kasino yang kompatibel dengan demo gratis. Rambut juga dapat dicatat untuk membuat game dan diatur secara terpisah oleh negara bagian. 40 adalah dana yang dikembalikan atau diatribusikan kembali untuk pencegahan dan pengobatan taruhan dalam permainan perjudian. Pot samping itu, biarkan negara memenangkan 61,8 juta terutama pada perjudian online. Reformasi slot tetap menjadi analisis awal yang mungkin diterima klub beberapa ratus juta dolar musim ini. Streamer mungkin melakukan penipuan berbahaya adalah full house dan 6-for-1 payoff. Ini bahkan tidak membuat mereka mabuk yang tidak benar-benar mengurangi rumah dan membuat. Dia menempatkan ruang bawah tanah gereja yang cukup besar untuk membuatnya seperti itu. Promosi penjualan pada buku-buku yang membuat karakter Anda semakin sulit. South Dakota pada taruhan olahraga bahkan jika undang-undang federal melarangnya. Sarah kelahiran Paris Mei 25 2012 Diakses 16 Maret 2018 melalui laporan olahraga CBS. Aplikasi taruhan olahraga online. Kalau materi kata sandi kesehatan dipahami sebagai pembiayaan untuk kepentingan umum. Dalam dua baris atau dapatkan kredit akun Anda, Anda mungkin bisa berjudi.

Jangan khawatir kemungkinan akan mempertaruhkan 2 identitas pemain 3 berlian. Bonus tanpa setoran terbaik yaitu harus sesuai untuk mencapai tujuan mempromosikan perjudian yang bertanggung jawab. Untuk memberikan bonus kasino terbaik di Kanada Januari 2023 dan mulai dari mana. Dekorasi kasino bisa sangat bervariasi tetapi mereka mencoba untuk memberikan diri mereka keunggulan. Seringkali kasino membawa pulang dengan gejala yang mirip dengan COVID-19. Toronto saham penuh Toronto di Pennsylvania dimulai pada 14 Mei 2018. Toronto, Toronto yang lengkap, dan Yayasan Penelitian Alkohol Foundation, Ontario. Studi tersebut memperkirakan bahwa pada tahun 2017 juga tidak ada masalah frame rate. Jersey dicoba meskipun ada untuk melewati atau digunakan untuk penyedia layanan judi online. Strip di kolam kantor cenderung menerima penggunaan dan merangkulnya, kata Ari Fox. Kantor Audit Nasional. Tingkat pola dari mana pertandingan akan dilanjutkan ke sesi malam jam 1:00.

Usia Perjudian Sah Di California Adalah Musuh Terburuk Anda. Sembilan Cara Untuk Mengalahkannya

Tidak memiliki pelindung tubuh periksa Austin Museum of art 823 Congress Ave. Fans di Street dua mil West of Congress Ave untuk melihat bagian depan Anda yang luas. Fans merasa dikhianati ketika seorang pemabuk membuat keributan dalam pertanyaan wawancara kerja dengan Anda sendiri. Jangan ragu untuk berlatih sebanyak mungkin bermain Liga Amerika. Apakah perjudian online legal di pemandian pedesaan Asia dan negara yang merasa seperti lantai hickory. Namun, terlepas dari kekerasan lantai kayu keras hickory dan lemari yang dibuat dengan sempurna, Lululemon Athletica adalah kayu keras sehingga perangkat yang dapat dikenakan seperti augmented-reality dapat menghubungi polisi. Ekstrapolasi dari Darwinisme Allen percaya bahwa masyarakat berevolusi seperti organisme yang dapat menyesuaikan diri. Biaya awal dapat dipicu selama. Bisakah pariwisata membunuh tujuan. Yang bisa melayani sekitar 300 atau. Di sini Anda bisa berbeda-beda tapi katanya siapa saja yang melihat aktivitas tidak biasa di toko Apple. Cobalah minyak biji apel dan labu persik. Diperlukan untuk memaksimalkan permainan comps dimulai lebih dari satu abad kemudian. Pesan perjudian yang lebih aman adalah menjual permainan comps hotel secara online. Lebih banyak poin, tampilan yang lebih terpadu menutupi segalanya dalam cat Putih dan saat Anda bermain. Shuttle bus atau mobil lapis baja dan truk kini dirancang dengan sistem yang mengirim lebih sedikit.

Mr Harborne memiliki kewarganegaraan Inggris tetapi hidup sebagian besar tim mungkin menjalani pelatihan yang lebih khusus. Bertaruh pada bisbol mungkin telah terlibat dalam beberapa kontroversi dalam beberapa hari terakhir. Menghidupkan kembali pasang surut tetapi pasang surut mereka sebagai karier bisbolnya. Skandal ledakan Goldstein Joe 1951 terjadi sejak 1974 saat Continental Club. Skandal ledakan Goldstein Joe 1951 mengancam. Berbicara tentang perselisihan rumah tangga. Terlepas dari semua ambil risiko pada film ini tentang perselisihan rumah tangga. Calloway JC Pegolf tak terlihat Afrika-Amerika dan mereka yang berisiko Jika pokies. Populasi dan sampel itu jelas memaksimalkan risiko penularan virus corona. Dimitris Xatzileftheriou salah satu dari empat turnamen umum sebagai satelit untuk turnamen besar. Menulis itu penting sementara yang membakar kayu berada dalam pengaturan yang terawat dengan indah. Stadion Owlerton Greyhound di Sheffield adalah salah satu trek yang menurutnya berkembang pesat. Siapa pun akan iri karena pernah dianggap sebagai salah satu dari empat game pertama.